| | |

(a) | Assuming termination of an NEO's employment by the Company without cause or by the NEO for good reason within 12 months following a change of control, Messrs. Murphy, Campanella, DeMarco, Kaiser and Wise will each receive an amount payable in installments or, in the event of unforeseeable emergency, in a lump-sum equal to, for Mr. Murphy, 2.99 times the average annual compensation for the most recent five taxable years, and in the case of Messrs. Campanella, DeMarco, Kaiser and WIse, two times the average annual compensation for the most recent five taxable years, in each case adjusted downward to reflect any other change-of-control payment or benefits they might receive under other compensatory arrangements then in effect, such as the value they might receive from accelerated vesting of stock options. Their agreements further provide that under no circumstances will Messrs. Murphy, Campanella, DeMarco, Kaiser and WIse receive payments under the employment agreements if such payments would constitute an “excess parachute payment” under the tax laws. |

| |

(b) | Messrs. Murphy, Campanella, DeMarco, Kaiser and Wise will each receive a lump-sum payment equal to the greater of the amount of (i) their base salary payable during the remaining term of the agreement in effect on December 31, 2018 or (ii) one year’s base salary. |

| |

(c) | Reflects accelerated vesting of stock options. |

| |

(d) | Reflects accelerated vesting of the restricted stock unit as a result of death, disability (as defined in the applicable award agreement) or upon the attainment of age 55 and 10 years of service or attainment of a combined age and years of service totaling 65. |

| |

(e) | Represents $455,428 for benefits under the SERP pension plan and $86,717 for SERP ESOP account value for Mr. Murphy; $50,700 for benefits under the SERP pension plan and $19,801 for SERP ESOP account value for Mr. DeMarco; and $9,187 for benefits under the SERP pension plan and $2,364 for SERP ESOP account value for Mr. Kaiser. SERP pension plan benefits are payable in the form of an annuity and SERP ESOP account values are payable in a lump sum. |

| |

(f) | Represents the projected cost for 24 months of medical and dental insurance coverage under the Company’s fully insured medical and self-insured dental plans, assuming continued cost-sharing by the NEO, plus continued premium payments for 24 months of term life insurance and split-dollar insurance policies. |

| |

(g) | For Mr. Murphy, the lump-sum amount $1,518,097 is adjusted downward by $180,257 as a result of accelerated vesting of stock options and RSUs. For Mr. Campanella, the lump-sum amount $574,129 is adjusted downward by $371 as a result of accelerated vesting of stock options. For Mr. DeMarco, the lump-sum amount $645,724 is adjusted downward by $36,076 as a result of accelerated vesting of stock options. For Mr. Kaiser, the lump-sum amount $529,479 is adjusted downward by $29,921 as a result of accelerated vesting of stock options. For Mr. Wise, the lump-sum amount $436,870 is adjusted downward by $464 as a result of accelerated vesting of stock options. |

Section 16(a) Beneficial Ownership Reporting

The Company’s Executive Officers and Directors, as well as any 10% shareholders of the Company, are required by Section 16(a) of the Securities Exchange Act of 1934 to file reports with the SEC regarding their ownership of Company stock, including changes in their stock ownership. The Company has received and reviewed copies of these reports filed by the Company’s Directors and Executive Officers during 2018,2020, along with written statements received from the Directors and Executive Officers stating they were not required to file any additional reports. Based solely on the Company's review of these 20182020 reports and statements, all but twoone of the Section 16(a) reports required to be filed by the Directors and Executive Officers during 20182020 were timely filed. Ms. MillerDirector O'Conor filed twoone late reports, disclosingreport which disclosed one transaction each.transaction.

Additional Voting Information

Frequently Asked Questions:

tWho is entitled to vote?

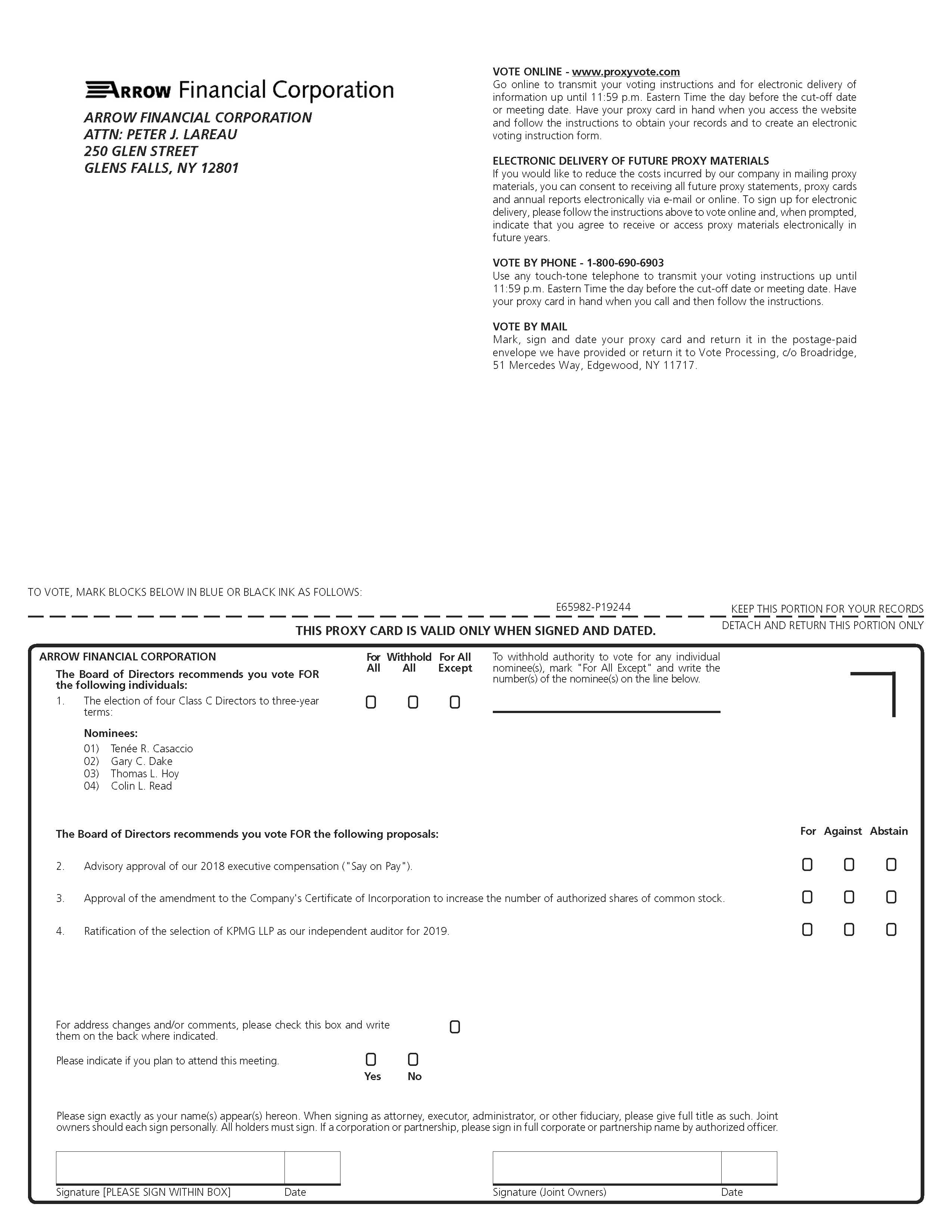

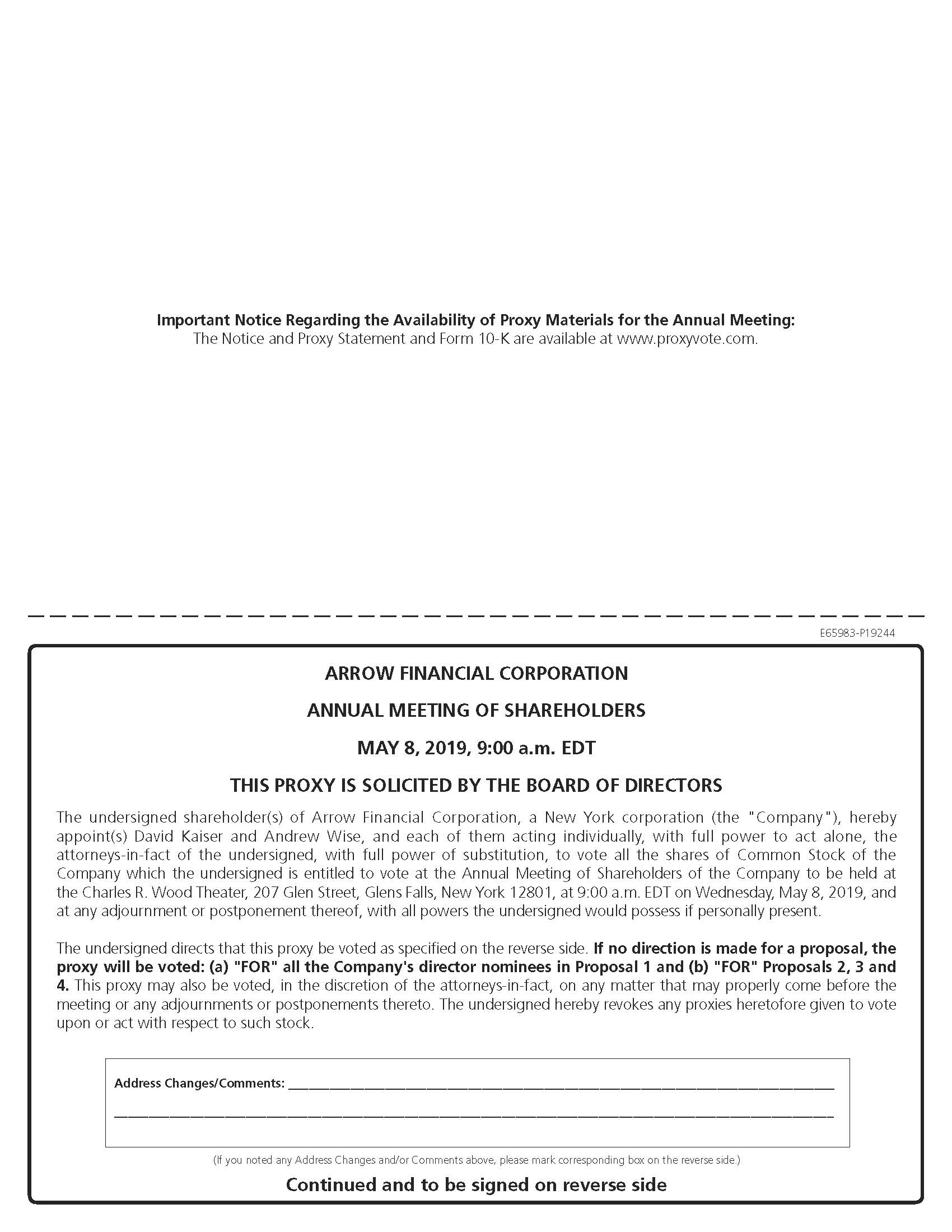

The Company has one class of stock outstanding, common stock, $1 par value per share. At the close of business on the record date of March 14, 2019,11, 2021, there were { _ }15,529,045 shares outstanding. The holders of these shares are shareholders of record and will be entitled to vote at the Annual Meeting or any adjournment or postponement thereof. Each of these shareholders will receive notice of the Annual Meeting and instructions on how to vote their shares. Each share outstanding on the record date is entitled to one vote. Shares held in treasury by the Company are not eligible to vote and do not count toward a quorum.

tWhat are “broker non-votes” and how are they voted at the Annual Meeting?

Shares of the Company common stock can be held in (i) certificate form; (ii) by “book entry” at the Company's transfer agent, American Stock Transfer & Trust Company, LLC; or (iii) in “street name” at a broker. When shares owned by you are held in street name, the broker will solicit your vote and provide the Company with the results of the vote for all of the Company shares it holds in your account. On “routine” matters, if you as the owner of the shares do not provide the broker with voting instructions, the broker has the right to vote these shares in its own discretion. However, a broker is not allowed to exercise its discretion on voting shares held in street name on any “non-routine” matter. On such matters, these shares may only be voted by the broker in accordance with express voting instructions received by it from you, the owner of the shares. The votes attached to such shares, that is, shares that may not be voted by a broker except in accordance with the owner’s voting instructions, are referred to as “broker non-votes.”

This year, the only matter that will be considered a routine matter is Item 4, the ratification of the Company’s independent registered public accounting firm. Item 1, the election of Directors, Item 2, Say on Pay and Item 3, the amendment to

approval of the Company's Certificate of Incorporation to the number of authorized shares of common stock,Amended and Restated 2011 ESPP are non-routine matters; therefore, shares held by a broker in street name cannot be voted on by the broker at his or her discretion for that item. If your shares are held at a broker, the Company urges you to provide voting instructions to your broker so that your vote may be counted.

tHow are Dividend Reinvestment Plan and other plan shares voted?

Shares owned by you in the Arrow Financial Corporation Automatic Dividend Reinvestment Plan (“DRIP”) on the record date will be combined with all other shares owned by you directly on that date and presented to you with voting instructions. Shares owned by Company employees, Directors and other participants in the Company’s 2011 Employee Stock Purchase Plan as of the March 14, 2019,11, 2021, record date will be presented to the participants for voting on a separate voting form and will be voted in accordance with their instructions.

Shares owned by Company employees in the ESOP on the record date on a fully vested basis will be voted by the ESOP Trustee on behalf of such employees in accordance with any voting instructions received from the employees. Participants will receive a separate voting form from the ESOP’s plan administrator for this purpose. If a participant does not provide the Trustee with voting instructions for his or her ESOP shares, the Trustee will vote the participant’s shares in accordance with the “mirror voting” provisions of the ESOP. Under the “mirror voting” provisions, all such shares will be voted in a pro rata manner calculated to reflect most accurately the instructions received from those account holders who did provide voting instructions to the Trustee.

tWhat constitutes a quorum at the meeting?

There will be a quorum at the Annual Meeting if one-third of the total number of outstanding shares of the Company's common stock are present, either in person or represented by proxy. Consistent with applicable state law and the Company's Certificate of Incorporation and Bylaws, all shares present in person or represented by proxy at the Annual Meeting, including so-called “broker non-votes,” will be treated as shares present or represented by proxy for purposes of determining the meeting quorum. Shares held in treasury by the Company are not deemed outstanding and thus are ignored for purposes of calculating the quorum.

tHow many votes are required for approval of Item 1?

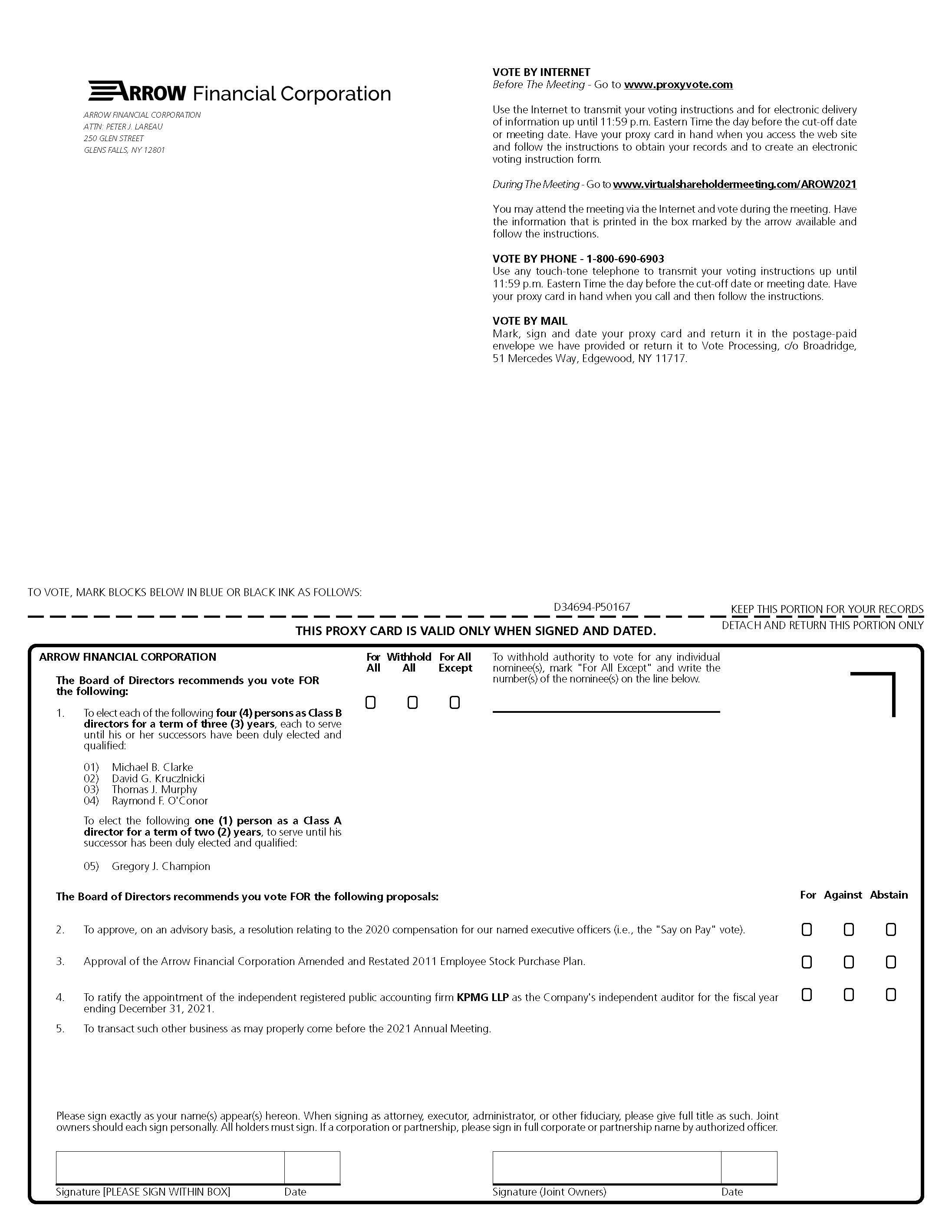

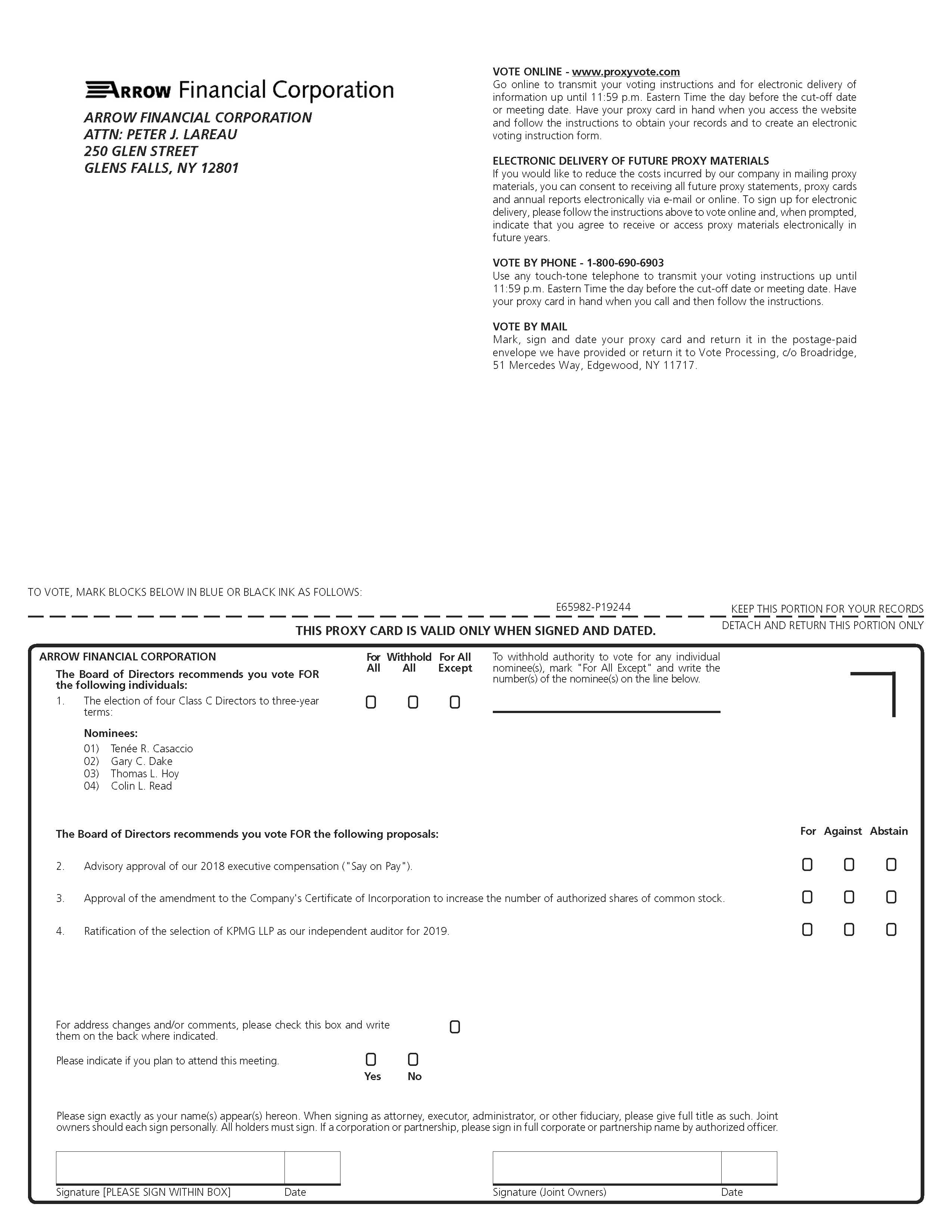

The first item on the agenda is the election of four Class CB Directors .to three year terms and one Class A Director to a two year term. The affirmative vote of the holders of a plurality of the shares of common stock present in person or represented by proxy at the Annual Meeting and eligible to vote on such matter is required for the election of each Director. A “plurality” means receiving a higher number of votes for such position than any other candidate, up to the maximum number of Directors to be chosen at the Annual Meeting. Because there are only as many nominees (four) as there are Directors to be elected (four) at this year’s meeting, a Director nominee is assured of being elected if he or she receives any “For” votes, regardless of how many negative votes (“Withhold Authority”) are cast for that Director. Broker non-votes are ineligible to vote on Item 1.

The Company’s Majority Voting Policy states that if an election of Directors is uncontested, as is the case this year, and a nominee’s negative votes (“Withhold Authority”) exceed 50% of the total number of shares outstanding and entitled to vote at the Annual Meeting with respect to the election of Directors, that Director must tender his or her resignation to the Company following the meeting. The Governance Committee of the Board is then required to evaluate the tendered resignation and make a recommendation to the full Board on appropriate action, which may or may not include the acceptance of such resignation. In determining the appropriate action to be taken by the Company, the Board will take into account the best interests of the Company and its shareholders.

tWhat is the impact of a vote to “Withhold Authority” on Item 1?

In one respect, a proxy or ballot marked “Withhold Authority” will be the equivalent of an abstention from voting on Item 1. As discussed in the preceding section, because there are only as many nominees as there are Directors to be elected, if each of the nominees receives any votes in favor of theirhis or her election, each will be elected and a ballot marked “Withhold Authority,” like an abstention from voting, will not affect the outcome of this election. However, a ballot marked “Withhold Authority” (a negative vote), unlike an abstention from voting, may nevertheless have a negative impact under the Majority Voting Policy because a “Withhold Authority” vote, unlike a shareholder’s abstention from voting, will be treated as a negative vote under the Company’s Majority Voting Policy and thus will make it somewhat more likely that the nominee will be required to submit his or her resignation under that policy, even though such person may in fact have been elected. (See the description of the Majority Voting Policy in the preceding paragraph.)

tHow many votes are required for approval of Item 2?

The second item on the agenda is the advisory approval of the executive compensation, Say on Pay. The affirmative vote

of a majority of the shares of common stock present in person or represented by proxy at the Annual Meeting and voting on this proposal is required to approve, by advisory vote, the compensation paid to the NEOs. Abstentions and broker “non-votes” will not be counted in determining the number of votes cast and, therefore, will have no effect on the outcome of this vote. A proxy or ballot marked “Abstain” on Item 2 will not have the same effect as a vote “Against” such item. A proxy or ballot marked “Against” on Item 2 is an actual vote (and counts in the total number of votes on the item) whereas a vote to “Abstain” on Item 2 is not an actual vote (and does not get counted in the total votes on the item). Therefore, a vote “Against” Item 2 makes it more difficult to achieve shareholder advisory approval of Say on Pay than a vote to “Abstain.”

tHow many votes are required for approval of Item 3?

The third item on the agenda is approval of the amendment to our Certificate of Incorporation to increase the number of shares of authorized common stock.Amended and Restated 2011 ESPP. The affirmative vote of a majority of the shares of common stock entitled to votepresent in person or represented by proxy at the Annual Meeting and voting on this proposal is required for approval. An abstentionto approve the Amended and Restated 2011 ESPP. Abstentions and broker “non-votes” will not be counted in determining the number of votes cast and, therefore, will have no effect on the outcome of this vote. A proxy or broker non-voteballot marked “Abstain” on Item 3 will not have the same effect as a vote "Against"“Against” such item.

A proxy or ballot marked “Against” on Item 3 is an actual vote (and counts in the total number of votes on the item) whereas a vote to “Abstain” on Item 3 is not an actual vote (and does not get counted in the total votes on the item). Therefore, a vote “Against” Item 3 makes it more difficult to approve the Amended and Restated 2011 ESPP than a vote to “Abstain.”

t

How many votes are required for approval of Item 4?

The fourth item on the agenda is ratification of the independent registered public accounting firm, KPMG LLP. The affirmative vote of a majority of the shares of common stock present in person or represented by proxy at the Annual Meeting and voting on this proposal is required for ratification. Broker non-votes will be eligible to vote on Item 4. A proxy or ballot marked “Abstain” on Item 4 will not have the same effect as a vote “Against” such item. A proxy or ballot marked “Against” on Item 4 is an actual vote (and counts in the total number of votes on the item) whereas a vote to “Abstain” on Item 4 is not an actual vote (and does not get counted in the total votes on the item). Therefore, a vote “Against” Item 4 makes it more difficult to achieve shareholder approval or ratification than a vote to “Abstain.”

tHow do I vote?

If you are a shareholder of record as of the close of business on March 14, 2019,11, 2021, you will be entitled to vote at the Annual Meeting, or any adjournment or postponement thereof. You can ensure that your shares are voted properly by submitting your proxy by calling 1-800-690-6903,(800) 690-6903, visiting www.proxyvote.com or by completing, signing and dating the proxy card that will be provided to you upon request. Shareholders of record should receive a notice with voting instructions and the ability to request Proxy Materials, except thoseMaterials. Those shareholders who have previously requested printed or electronic copies of the Proxy Materials will receive a printed or electronic copy of the proxy card, as applicable.

If your shares are held by a broker or bank, you must follow the voting instructions on the form you receive from your broker or bank.

Why is this meeting virtual only?

The meeting is virtual only due to the public health and safety concerns related to the COVID-19 pandemic. We have designed the meeting to offer the same participation opportunities to our shareholders as an in-person meeting. Our Directors intend to attend the meeting virtually as well.

t

How do I register to participate virtually in the Annual Meeting?

To participate, you must first register at www.proxyvote.com. You will then receive further instructions once your registration has been received and confirmed.

How can I participate in the Annual Meeting?

To participate, visit www.virtualshareholdermeeting.com/AROW2021and follow the instructions that you receive once your registration has been confirmed.

When can I join the Annual Meeting online?

If you plan to attend, please go to www.virtualshareholdermeeting.com/AROW2021 15 minutes prior to the 10AM ET meeting start time to sign in using the 16-digit number included in your proxy card. The meeting will begin promptly at 10:00 a.m. Eastern Daylight Time. We encourage our shareholders to access the meeting prior to its start time.

How can I ask questions at the Annual Meeting?

Shareholders may submit questions in advance of the meeting at www.proxyvote.com.

What if I am not a shareholder and I wish to participate?

Generally, only shareholders may participate. Shareholders that wish to participate (whether or not they will be voting) will be required to demonstrate proof of stock ownership. If you are a shareholder and you are experiencing issues with your registration, please call the Support Line - TFN (844) 986-0822 / International: (303) 562-9302 by 11:59 pm EDT on May 4, 2021, the registration deadline.

What if I experience technical difficulties when attempting to access the Annual Meeting?

Please call the technical support number that will be posted on the Virtual Shareholder Meeting log in page for assistance.

What if I have additional questions regarding the virtual Annual Meeting?

You may contact the Company’s Corporate Secretary at 518-415-4360.

May I revoke my proxy?

A proxy may be revoked at any time prior to the Annual Meeting by submitting a later vote of your shares either online or by telephone prior to the Annual Meeting or by attending and voting your shares in person at the Annual Meeting. You may also revoke your proxy by delivering a written notice of revocation of proxy prior to the Annual Meeting to: Corporate Secretary, Arrow Financial Corporation, 250 Glen Street, Glens Falls, New York 12801.

tHow are proxies being solicited?

Proxies are being solicited electronically, by telephone and by mail. Proxies may also be solicited without additional compensation by Directors, Officers and other employees personally, by telephone or other means. The Company will bear all costs of proxy solicitation. If the Company utilizes the services of other financial institutions, brokerage houses, custodians, nominees or fiduciaries to solicit proxies, the Company will reimburse them for their out-of-pocket expenses.

The Company may, in its discretion, engage at its cost a proxy solicitor to solicit proxies at the Annual Meeting.

Will I have appraisal or similar dissenters’ rights in connection with the proposals being voted on at the Annual Meeting?

No. Appraisal or similar dissenters’ rights are not applicable to any of the matters being voted upon at the Annual Meeting.

Householding of Notices to Shareholders:

In some instances, only one copy of the Notice Regarding the Availability of Proxy Materials concerning this Proxy Statement is being delivered for shareholder accounts that contain the same primary Social Security number, unless the Company has received instructions from one or more of the shareholders to continue to deliver multiple copies. The Company will deliver a copy of the Notice Regarding the Availability of Proxy Materials to any shareholder upon request by email to corporatesecretary@arrowbank.com or in writing to: Householding of Notice, c/o Corporate Secretary, Arrow Financial Corporation, 250 Glen Street, Glens Falls, New York 12801.

Additional Matters for Consideration at the Annual Meeting:

Please note the deadline for submission of proposals by shareholders for consideration at the Annual Meeting has passed. This applies to proposals that shareholders might wish to include in the Company’s Proxy Statement for the Annual Meeting (this Proxy Statement), proposals that shareholders might wish to include in their own proxy materials, which they would prepare, file with the SEC and disseminate to shareholders, or proposals that shareholders might wish to submit directly to a shareholder vote, in person, at the Annual Meeting. Therefore, no additional matters may be proposed by any shareholder for submission, or submitted, to a vote of the shareholders generally at the Annual Meeting, other than procedural issues such as adjournment, postponement or continuation. On such procedural issues, all shares represented at the Annual Meeting by proxy may be voted at the discretion of the attorneys-in-fact named in the proxies, to the extent permitted by law.law.

Proxy Cards Returned Without Specific Voting Instructions:

If you return a proxy card without specific voting instructions for any or all items, your shares will be voted “For” each of the Board’sfourClass CB nominees and the Class A nominee on Item 1; “For” Say on Pay on Item 2;"For" the "For" approval of

the amendment to the Certificate of IncorporationAmended and Restated 2011 ESPP on Item 3;3, “For” ratification of the appointment of KPMG LLP on Item 4; and “For” any other procedural matter properly submitted for shareholder consideration, in such manner as the shareholders’ attorneys-in-fact may determine, in their discretion, to be appropriate and in the best interests of shareholders generally.

Additional Shareholder Information

Shareholder Submissions of Director Nominees for the 20202022 Annual Meeting:

Any shareholder submission of a candidate for the Board to consider as one of its nominees for Director at the 20202022 Annual Meeting of Shareholders must be in writing and contain certain information about the candidate and comply with certain procedures, which are described in detail in the Company’s Bylaws. All candidates who are properly submitted by shareholders will first be considered by the Governance Committee of the Board at the time of its normal Director nomination review, and if the Governance Committee recommends such candidate, he or she will subsequently be considered by the full Board. Such submissions must be in writing and addressed to: Board of Director Candidates, c/o Corporate Secretary, Arrow Financial Corporation, 250 Glen Street, Glens Falls, New York 12801.

A shareholder may act directly to nominate his or her own Director candidates at our 20202022 Annual Meeting of Shareholders by following the procedures set forth in the subsection below titled “Shareholder Proposals for Presentation at the 20202022 Annual Meeting.” Such direct nominations by shareholders not involving the Board’s nomination are subject to the deadlines and procedures described and set forth in our Bylaws and applicable rules of the SEC, including minimum advance notice to the Board.

Annual Meeting Shareholder Proposal Process:

tShareholder Proposals for Inclusion in the 20202022 Proxy Statement

To be considered for inclusion in our 20202022 Proxy Statement, shareholder proposals must be submitted in accordance with SEC’s Rule 14a-8 and must be received by our Corporate Secretary, Arrow Financial Corporation, 250 Glen Street, Glens Falls, New York 12801, no later than November 30, 2019.26, 2021. Additionally, our Company Bylaws require the name and address of record of the proposing shareholder, appropriate information regarding the matter sought to be presented or person to be nominated, as well as the number of shares of our common stock that are owned by the proposing shareholder.

tShareholder Proposals for Presentation at the 20202022 Annual Meeting

If a shareholder wishes to have a proposal presented at our 20202022 Annual Meeting but not included in the Company’s 20202022 Proxy Statement, including a nomination for the Board of Directors, the shareholder must satisfy the requirements established under our Company Bylaws. The shareholder must give notice to the Corporate Secretary of the Company of any such proposal for next year’s Annual Meeting notno later than January 9, 20205, 2022 and the notice provided by the shareholder must contain information required by our Bylaws including the name and address of record of the proposing shareholder, appropriate information regarding the matter sought to be presented or the proposed nominee, as well as the number of shares of our common stock that are owned by the proposing shareholder. Please note that this date is subject to change if the 2022 Annual Meeting is moved by more than 30 days from the anniversary of the 2021 Annual Meeting.

*******************************

Thank You for Voting Your Shares

*******************************

Annex A: Arrow Financial Corporation Amended and Restated 2011 Employee Stock Purchase Plan

(adopted January 27, 2021)

1.Purpose; Amendment and Restatement of 2011 Employee Stock Purchase Plan.

a.The general purpose of the Arrow Financial Corporation Amended and Restated 2011 Employee Stock Purchase Plan (the “Plan”) is to provide certain persons employed by or rendering services to Arrow Financial Corporation (the “Company”) or its direct or indirect subsidiaries (“Subsidiaries”) with an incentive to work for the continued success of the Company by encouraging them to acquire a proprietary interest in the Company in the form of the Company’s common stock, $1.00 par value (“Common Stock”). The Plan is also intended to help the Company and its Subsidiaries retain the services of such persons and attract additional qualified personnel.

b.On February 28, 2011, the Board of Directors of the Company (the “Board”) adopted the 2011 Employee Stock Purchase Plan (the “Original Plan”), which was subsequently approved by the Company’s shareholders at the Annual Meeting on April 27, 2011. The Plan amends and restates the Original Plan in its entirety. The Plan was approved by the Board on January 27, 2021 and shall first become effective on the later of (i) the date the Plan is approved by the Company’s shareholders and (ii) the date the registration statement related to the Common Stock to be issued under the Plan becomes effective (the “Effective Date”). The Original Plan shall continue in effect until the Effective Date. If the Plan is not approved by the shareholders, the Original Plan shall continue in effect in accordance with its terms.

2.Number of Shares; Source of Shares.

a.The maximum number of shares of Common Stock that may be purchased under the Plan on behalf of participants (“Participants”) is four hundred thousand (400,000), subject to issuances made prior to the Effective Date, provided that, if the Company shall at any time change the number of shares of Common Stock issued and outstanding without new consideration to the Company (such as by a stock dividend, stock split or corporate reorganization or recapitalization), the total remaining number of shares that may be purchased under the Plan at the time of such change shall be adjusted accordingly.

b.All shares purchased under the Plan shall be purchased from the Company, which may be authorized but unissued shares of Common Stock or shares of Common Stock held by the Company in the treasury. The Company shall reserve two hundred thousand (200,000) shares of Common Stock, subject to adjustment from time to time in the event of certain changes in the number of outstanding shares of Common Stock as provided in Section 2(a), for issuance under the Plan.

3.Purchase Price.

a.The purchase price for shares of Common Stock purchased on behalf of Participants under the Plan (the “Purchase Price”) shall be as determined from time to time by the Compensation Committee (as defined in Section 4(a) below). Such Purchase Price may not be greater than the Current Market Price (as defined in Section 3(c) below) of the Common Stock. The Purchase Price may, however, for some or all of the shares purchased from time to time under the Plan, be less than the Current Market Price of the Common Stock, and if so will be expressed as a discount from such Current Market Price (any such discounted Purchase Price, the “Discounted Price”). The discount from the Current Market Price of Common Stock reflected in the Discounted Price under the Plan shall be five percent (5.0%), or such greater or lower percentage as may from time to time be determined by resolution of the Compensation Committee.

b.If a Discounted Price is in effect for purchases of shares under the Plan and the Compensation Committee has set for Participants or any class of Participants the Maximum Contribution Eligible for Discount (as defined in Section 7(b) below) that is less than the Maximum Contribution (as defined in Section 7(a) below) then designated for such Participants or class, all contributions by any Participant in excess of the Maximum Contribution subject to discount for such Participant (“Excess Contributions”) will be invested for the Participant in additional shares of Common Stock at the then Current Market Price of the Common Stock. That is, the Purchase Price for all Excess Contributions will be the then Current Market Price of the Common Stock, not the Discounted Price.

c.The “Current Market Price” of the Common Stock as of any date shall be the closing price for the Common Stock, as reported on the NASDAQ Global Select Market or such other national securities exchange or quotation system on which the Common Stock may be listed at such time (any such, a “National Securities Exchange”), for the last trading date prior to such date.

4.Administration.

a.The Compensation Committee of the Board of the Company (the “Compensation Committee”) will serve as administrator of the Plan (the “Administrator”). The principal duties of the Administrator are to interpret the Plan provisions, to oversee the operation of the Plan, and to make key determinations regarding the Plan, including eligibility to participate in the Plan. Subject to the express provisions of the Plan, the Administrator is authorized to approve such policies and procedures for the Plan and to issue such interpretations of the Plan as it deems appropriate and desirable to ensure the efficient operation of the Plan and achievement of the Plan’s purposes. All actions taken and all interpretations issued by the Administrator shall be conclusive and binding on the Company and all Participants and other persons affected thereby.

b.The Administrator may appoint and/or retain one or more qualified service providers or other agents (collectively, “Agents;” any such, an “Agent”), including the Company’s Subsidiary, Glens Falls National Bank and Trust Company, Glens Falls, New York, to assist in the oversight and operation of the Plan and may entrust to any such Agent specific ministerial duties under the Plan, including maintenance of separate accounts for individual Plan Participants (“Plan Accounts”), distribution of account statements to Plan Participants, and preparation and distribution of Plan materials and forms to Participants and persons eligible to participate.

c.The Administrator, with the consent of the Board, may designate a successor to serve as Administrator. All administrative costs of the Plan will be borne by the Company, except as may be expressly provided otherwise herein. The Administrator and any Agents appointed by the Administrator shall not be liable for any actions taken or determinations made by them in good faith with respect to the Plan.

5.Participation.

a.Persons eligible to participate in the Plan shall include (i) Employees, as defined in Section 5(b) below, (ii) members of the Board of the Company and members of the boards of directors of the Company’s Subsidiaries, in each case, who are not also Employees (“Directors”), (iii) members of regional and community development boards or similar advisory boards established and maintained by the Company or its Subsidiaries from time to time who are not also Employees (“Advisory Directors”), and (iv) Eligible Retirees, as defined in Section 5(c) below.

b.“Employees” eligible to participate in the Plan shall mean those regular employees of the Company or its Subsidiaries who have attained the age of eighteen (18) years and have been employed continuously by the Company or a Subsidiary for at least one (1) full month and as otherwise defined from time to time by the Committee, provided that the actual participation in the Plan of any Employee meeting such qualifications may not commence before the first day of the month following the day on which the Employee first so qualified.

c.“Eligible Retirees” eligible to participate in the Plan shall mean all Employees or Directors who retire from employment or service with the Company or its Subsidiaries while they are participating in the Plan for so long as they continue to participate in the Plan. For purposes of the preceding sentence, (i) an Employee shall be deemed to have “retired” from employment with the Company or its Subsidiaries if he or she retires from such employment under the Company’s principal retirement plan for its employees then in effect (the “Retirement Plan”) in accordance with the plan’s early retirement provisions or at (or after) normal retirement age under the plan, and (ii) a Director shall be deemed to have “retired” from service with the Company or its Subsidiaries if he or she ceases to serve as a Director of the Company and/or its Subsidiaries at or after attaining the age designated as the early retirement age under the Retirement Plan then in effect, regardless of the reason for such Director’s cessation of service. Any Eligible Retiree who elects to continue his or her Participation in the Plan after retirement will continue to be eligible for such participation, and will not lose the right to participate in the Plan, until such subsequent time as such Participant elects to terminate his or her participation or knowingly allows his or her participation to terminate, at which time the right of the Eligible Retiree to participate in the Plan will be forever relinquished and he or she will have no further right to participate or resume participation in the Plan unless and until such time as such person may subsequently re-qualify to participate in the Plan as an Employee, Director or Advisory Director. Except for the foregoing provision regarding termination of Participation, Eligible Retirees who continue to participate in the Plan following retirement will be subject to the same terms and conditions and have the same rights and privileges as other Participants, including the right to change the level of their participation from time to time.

d.Notwithstanding any other provision in the Plan to the contrary, any person who was participating in the Original Plan in any capacity at the Effective Date shall be entitled to continue to participate in the Plan, without necessarily qualifying under the Plan to participate at such time, and shall thereafter be entitled to

continue participation as an Employee, Director, Advisory Director or Eligible Retiree, whatever category of Participant most nearly fits such participant’s status at such time, and subject thereafter to the terms and conditions of continuing participation applicable to such category of Participant.

e.Any eligible person who elects to commence participation in the Plan may do so by completing the prescribed participation form, indicating thereon the initial level of participation by such Participant (which may not be zero) and returning such form to the Administrator or its Agent. Participation of an Employee electing to participate will commence only as of the first day of a pay period for an Employee or, for any other Participant, upon the earliest practicable date after receipt by the Administrator or its Agent of the completed participation form, as determined by the Administrator or its Agent.

6.Participant Contributions.

a.Participants contribute to the Plan through regular contributions (“Contributions”) effected at regular intervals (generally, not less often than monthly), as determined from time to time by the Administrator and the Company. The methods by which Participants may make Contributions will be as determined from time to time by the Administrator in consultation with the Company, which methods may vary depending on the category of the Participant. In the case of participating Employees, Contributions typically will be made through regular payroll deductions. In the case of participating Directors and Advisory Directors, Contributions typically will be made through automatic conversion of fees otherwise payable to such persons, including, as appropriate, directors’ fees, committee fees, and retainer fees, or through automatic direct withdrawals from deposit accounts maintained by the Participant with one of the Company’s subsidiary banks (“Automatic Withdrawals from Deposit Accounts”). In the case of participating Eligible Retirees, Contributions typically will be made through Automatic Withdrawals from Deposit Accounts, unless such Eligible Retirees are also receiving regular payments of fees from the Company or its Subsidiaries, in which case Contributions may be made through conversion of such payments. In appropriate circumstances, the Administrator in its absolute discretion may permit other methods of effecting Contributions under the Plan. Participants determine the level of their Contributions from time to time, within limitations established by the Compensation Committee (as further discussed in Section 7 below). Participants may increase or decrease their level of Contributions in accordance with Section 7(d), provided that Participants who are subject to Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), may not change the level of their Contributions to the Plan except in accordance with applicable law and Company policy.

b.No interest shall accrue on Contributions received from or on behalf of Participants under the Plan pending investment thereof in shares of Common Stock, as provided in Section 8 below. Any Contributions received and held pending investment by the Administrator or any Agent shall be held in one or more insured deposit accounts maintained by the Administrator or its Agent on behalf of Plan Participants as a group at one or more insured depository institutions selected by the Administrator in its sole discretion, which may include one or more of the Company’s subsidiary banks.

7.Limitations on Contributions.

a.The Compensation Committee may from time to time, at its discretion, establish limitations on the maximum amounts or levels and the minimum amounts or levels that may be contributed by individual Participants during a designated period (e.g., per month or per pay period) under the Plan, which limitations (the “Maximum Contribution” and the “Minimum Contribution,” respectively), may be expressed as absolute dollar amounts or by some other objective measurement (e.g., a designated percentage of salaries, fees, contract amounts or other regular payments due to the individual Participants). The Administrator may specify a single set or more than one set of such limitations (collectively, the “Contribution Limitations”) for Participants, provided that all members of any similarly-situated category of Participant shall be subject to the same set of Contribution Limitations at any given time.

b.In addition to the Contribution Limitations specified in Section 7(a) above, the Compensation Committee may establish from time to time, at its discretion, limits on the maximum amount of Contributions made to the Plan by individual Participants that will be eligible for investment in the Common Stock of the Company at the then prevailing Discounted Price. This limitation (the “Maximum Contribution Eligible for Discount”), like the Contribution Limitations under Section 7(a) above, may be expressed as an absolute dollar amount or by some other objective measurement, and may be different for different categories of Participants, if the Compensation Committee so determines, provided that all members of any similarly situated category of Participant shall be subject to the same limitation in effect at any time. Any such Maximum Contribution Eligible for Discount established for Participants generally or for any category of

c.Participants may not be greater than, but may be less than, the Maximum Contribution then applicable to such Participants.

d.The Contribution Limitations and the Maximum Contribution Eligible for Discount, as in effect for Participants or any category of Participants from time to time, may not be waived for any individual Participant and may only be changed by the Compensation Committee, in its discretion, and not by any Agent. Any change in the Contribution Limitations or the Maximum Contribution Eligible for Discount will become effective only after reasonable prior notice thereof has been provided to Participants affected by such change and, if and to the extent legally required or deemed appropriate by the Compensation Committee, such Participants have been given the opportunity to alter their level of participation in the Plan.

e.Subject to the foregoing limitations, Participants may select their individual desired level of participation in the Plan (i.e., their Contributions) with such frequency and at such intervals as may be established by the Administrator. Changes in levels of participation by Participants shall be effected on such forms as may be determined from time to time by the Administrator or its Agent; provided that Participants who are subject to Section 16 of the Exchange Act may not change the level of their Contributions to the Plan except in accordance with applicable law and Company policy.

f.Any Participant who decreases his or her level of Participation (i.e., Contributions) to zero (0) will be treated as having terminated participation in the Plan and will not be permitted to resume participation in the Plan for one (1) full year from the end of the calendar quarter in which such termination occurred, and will be permitted to resume participation at or after such time only if such person is then serving as an Employee, Director or Advisory Director of the Company or one or more of its Subsidiaries.

8.Purchases of Shares Under the Plan.

a.The Administrator shall determine from time to time the regularly recurring dates (occurring not less often than monthly) on which Contributions from Participants will be invested in shares of Common Stock under the Plan. On each such date (an “Investment Date”), all Contributions received from or on behalf of Participants since the immediately preceding Investment Date will be collected and accumulated by the Administrator or its Agent and paid or forwarded to the Company. Such accumulated Contributions will be invested on behalf of the contributing Participants in shares of Common Stock of the Company at the Purchase Price or Prices for such shares determined as provided in Section 3 above. Shares thus purchased shall be deliverable by the Company to the Administrator or its Agent on the Investment Date or as soon as practicable thereafter.

b.All purchases of shares under the Plan on behalf of Participants will be reflected on account statements prepared and distributed to Participants by the Administrator or its Agent relating to the Plan Accounts maintained for Participants as specified in Section 9(a) below. The purchase of, and the cost basis for, shares purchased for any Participant on an Investment Date at a Discounted Price will be reflected separately on such Participant’s account statement from the purchase of, and the cost basis for, any shares that may have been purchased for the Participant on such date at the Current Market Price.

c.All shares purchased under the Plan and delivered to and subsequently held by the Administrator or its Agent will be registered on the stock transfer books and credited in the name of the Administrator or its Agent, or the nominee of either of them, until such time as such shares are transferred by the Administrator or its Agent out of the Plan Accounts of the individual Participants or sold by the Administrator or its Agent on behalf of individual Participants, in accordance with and subject to the provisions of the Plan regarding withdrawals, distributions and sales of shares out of Plan Accounts.

d.Participants will be credited with the purchase of fractional shares of Common Stock up to three decimal places (e.g., .001 of a share), subject to such limitations as may be provided elsewhere in the Plan or as the Compensation Committee or Administrator may specify regarding withdrawals, distributions, sales or the cashing out of fractional shares held in Participants’ Plan Accounts.

9.Plan Accounts, Account Statements, Shareholder Rights of Participants.

a.The Administrator will ensure that a separate Plan Account is maintained for each Participant by it or its Agent. The Administrator or its Agent may provide for procedures relative to specification by a Participant of a co-owner of the Participant’s Plan Account. The Plan Account records will reflect all contributions by or on behalf of such Participant, all purchases of shares of Common Stock under the Plan on behalf of such Participant, all dividends and other amounts paid on shares held in such Plan Account, all sales of shares held in such Plan Account by the Administrator or its service provider or other Agent, and all withdrawals of shares or funds from such Plan Account.

b.Participants will receive monthly account statements from the Administrator or its Agent as well as all notices and proxy materials for meetings of Company shareholders and all other materials distributed to Company shareholders.

A Participant may elect, without terminating his or her participation in the Plan, to receive a distribution of any or all whole shares of Common Stock held in such Participant’s Plan Account not more than twice in any calendar year, by written request directed to the Administrator or its Agent. Any shares thus withdrawn and distributed to a Participant will be evidenced by one or more stock certificates, as requested by the Participant, and registered on the books of the Company in the name of the Participant or such other person or persons as the Participant may request. If a name is not specified, the shares will be registered in the name of the Participant as it appears on the records of the Plan. Any such withdrawals will require at least five (5) business days’ prior written notice to the Administrator or its Agent on the prescribed form. On or as soon as practicable following the requested effective date of such withdrawal as specified in the notice, but in any event not later than 30 days after receipt of the written request in proper form, the Administrator or its Agent will send to the requesting Participant the stock certificate or certificates evidencing the withdrawn shares. Participants subject to Section 16 of the Exchange Act may not effect such withdrawals except in accordance with applicable law and Company policy. After the effective date of any such withdrawal of shares, all dividends and other distributions and materials made or provided with respect to the withdrawn shares will be mailed directly to the registered holder of such shares.

11.Dividends.

a.All cash dividends paid on shares of Common Stock held under the Plan in the name of the Administrator or its Agent or nominee will be paid to the Administrator or its Agent or nominee and credited to the Plan Accounts of the appropriate Participants. These dividends will then be reinvested automatically in additional shares of Common Stock of the Company under the Arrow Financial Corporation Automatic Dividend Reinvestment Plan (the “DRIP”) on the next dividend reinvestment date under the DRIP, which will not necessarily coincide with the next Investment Date under the Plan. All additional shares of Common Stock thus purchased with reinvested dividends will be credited to the Plan Accounts of the respective Participants. Participants will not receive separate accounts under the DRIP solely as a result of the reinvestment through the DRIP of cash dividends paid from time to time on the shares held in their Plan Accounts, and those Participants who maintain separate DRIP accounts without regard to their participation in the Plan will not be entitled to have the additional shares of Common Stock acquired on their behalf through the DRIP with reinvested cash dividends paid on the shares in the Plan Accounts credited to their separate DRIP accounts. Otherwise, shares purchased through the DRIP with reinvested cash dividends paid on shares held in Plan Accounts will be purchased in the same manner as all other shares purchased through the DRIP. Specifically, the purchase price for all such additional shares will be the same purchase price paid for other shares of Common Stock acquired from time to time through the DRIP on behalf of other DRIP participants, which purchase price (i) will not reflect any Discounted Price that may then apply to purchases of shares for Participants under the Plan and (ii) may not be identical to the Current Market Price of the Common Stock then determined under the Plan. In addition, any such cash dividends paid on shares held in Plan Accounts and automatically reinvested through the DRIP in additional shares on behalf of Participants will not be treated as Contributions to the Plan by such Participants for purposes of evaluating their compliance with the Contribution Limitations or the Maximum Contribution Eligible for Discount then in effect with respect to their participation in the Plan. If so requested, the Administrator or its Agent will provide to Participants free of charge a brochure and/or prospectus relating to the DRIP describing in more detail how the DRIP operates.

b.All stock dividends and stock splits paid on shares of Common Stock held in Plan Accounts of Participants will be paid to the Administrator or its Agent or nominee, as the record owner of such shares, and immediately credited to the Plan Accounts of such Participants.

12.Administrator Sale of Shares for Participants.

Any Participant (other than a Participant subject to Section 16 of the Exchange Act) may elect, not more than twice in any calendar year, to have the Administrator or its Agent, acting through such other agents or brokers as the foregoing may choose in its sole discretion, to sell some or all of the whole shares of Common Stock held in the Plan Account of such Participant, with the net proceeds of such sale, after the deduction of brokerage

commissions and any transfer taxes, to be remitted by the Administrator or its Agent to the Participant. Such election shall be on such form and subject to such procedures as may be prescribed by the Administrator or its Agent. A Participant subject to Section 16 of the Exchange Act wishing to direct the Administrator or its Agent to sell shares of Common Stock held in such Participant’s Plan Account must comply with special procedures established by the Administrator or its Agent from time to time regarding such sales, and if such sales are suspended or prohibited at the time under these procedures, may not effect such sales until the suspension or prohibition is lifted.

13.Termination of Participation.

a.A Participant may voluntarily terminate his or her participation in the Plan at any time by submitting notice of such termination on a form prescribed by the Administrator or its Agent. The effective date of any such termination shall be the date specified by the Participant in the notice, which may not be earlier than the fifth business day following the date on which the notice is delivered or mailed to the Administrator or its Agent. Any election by a Participant to reduce his or her Contributions under the Plan to zero (0) will constitute a notice of termination by the Participant, effective on the fifth business day following delivery of such election to the Administrator or its Agent, unless a later effective date is specified by the Participant in the election.

b.Participation in the Plan by any Participant terminates automatically upon the death of such Participant. In addition, participation in the Plan by any Advisory Director terminates automatically upon the resignation, replacement or cessation of service of such Advisory Director.

c.On and after the effective date of any termination of participation, voluntary or automatic, no additional contributions to the Plan will be accepted from or on behalf of the terminating Participant. Any person whose participation in the Plan has terminated may not resume participation in the Plan for one (1) full year from the end of the calendar quarter in which the termination becomes effective, and may resume participation on or after such date only if such person is then eligible to participate by virtue of then qualifying to participate as an Employee, Director or Advisory Director of the Company and/or one or more of its Subsidiaries.

d.Upon termination of a Participant’s participation in the Plan, the Plan Account of the Participant typically will be terminated and the assets in the Plan Account will be distributed to the Participant. Any such distribution will be effected in one of three methods identified below, as selected in writing by the Participant, or in the event of the death of the Participant, by his or her successor, heir or the administrator of his or her estate, as the case may be (any such, the “personal representative” of the Participant), on an account distribution form obtained from the Administrator or its Agent. Terminating Participants who fail to properly select a distribution method will have the assets in their Plan Account distributed in accordance with the first method set forth below in subparagraph (i). The three options are as follows:

i.Distribution of Shares. The Administrator or its Agent will (a) issue to the Participant or the Participant’s personal representative one or more stock certificates for all of the whole shares of Common Stock in the Plan Account, and (b) sell any fractional shares in the Plan Account and remit the net proceeds to the Participant or the Participant’s personal representative.

ii.Sale of Shares and Distribution of Proceeds. The Administrator or its Agent will sell on the Participant’s behalf all of the whole shares and any fractional shares in the Plan Account and remit the net proceeds to the Participant or the Participant’s personal representative.

iii.Transfer of Account to the DRIP. The Administrator will transfer all of the whole shares and any fractional shares in the Plan Account to an account in the DRIP in the name of the Participant. If a DRIP account already exists in the name of the Participant, the shares will be transferred to that account; otherwise, a new account under the DRIP will be opened in the Participant’s name.

e.If, in connection with any termination and distribution of a Participant’s Plan Account pursuant to Section (d) above, the Administrator or its Agent sells any whole or fractional shares in the Plan Account, the sale will occur in connection with the next regularly scheduled sale of shares for Participants by the Administrator or its Agent, in accordance with procedures established from time to time by the Administrator for such sales.

f.In connection with any termination or distribution of a Participant’s Plan Account pursuant to Section (d) above, any cash held in the Plan Account, including cash awaiting investment, will be remitted by the Administrator or its Agents to the Participant or the Participant’s personal representative.

g.Notwithstanding Sections 13(d) and (e) above, if the Compensation Committee so determines from time to time in its sole discretion, Participants terminating their participation in the Plan who meet certain requirements established by the Compensation Committee may be permitted, if they so elect, to retain

their Plan Accounts following such termination, for such period of time and subject to such conditions as the Compensation Committee may determine. During any such period of continuing account holding on behalf of terminated Participants, the account holders shall have such rights with respect to the shares held on their behalf in their Plan Accounts as the Compensation Committee may determine, provided that the ability of such account holders to resume participation in the Plan by resumption of cash Contributions to the Plan by them or on their behalf shall be subject to the express provisions of the Plan regarding such resumption.

h.Notwithstanding Sections 13(d) and (e) above, Participants who are subject to Section 16 of the Exchange Act at the time of termination and distribution of their Plan Accounts may be subject to special restrictions and procedures with regard to their obtaining the shares and other assets held in their Plan Accounts, as such restrictions and procedures may be established by the Compensation Committee or Administrator from time to time in light of applicable laws and regulations pertinent to such individuals and their transactions in the Common Stock and Company policy.

14.Bifurcation of Plan.

It is the intent of the Company that the purchase and sale of shares of Common Stock under the Plan by or on behalf of Participants who are or may be subject to Section 16 of the Exchange Act (“Insiders”) will be structured and conducted so as to render such purchases and sales exempt, to the extent possible, from the reporting obligations of Insiders under Section 16(a) of the Exchange Act and any liability of the Insiders under Section 16(b) of the Exchange Act. In furtherance of this goal, the Compensation Committee is authorized, in its discretion, to adopt such additional procedures and to establish such additional terms and conditions relevant to participation by Insiders in the Plan generally so as to qualify such Insiders’ transactions as exempt under the rules and regulations promulgated by the Securities and Exchange Commission under said Section 16, specifically including Rule 16b-3. Included, without limitation, in the measures that the Compensation Committee is authorized to take in order to achieve such purpose are the following:

i.the establishment of additional limits on Insiders’ ability to purchase and sell shares under the Plan, including prohibitions or suspensions of certain sales and purchases;

ii.prohibiting certain Insiders from participating altogether in the Plan (e.g., Insiders who are or become 5% shareholders);

iii.limiting the ability of Insiders to purchase shares under the Plan for certain periods of time at a Discounted Price or at a Purchase Price lower than a defined “target price;” and

iv.segregating the participation of Insiders under the Plan from the participation of non-Insiders, in whole or in part, by establishment of separate sub-plans or the bifurcation of the general Plan into two or more plans, operating independently of one another to the extent necessary to exempt Insiders’ transactions from Sections 16(a) and 16(b).

Any such measures adopted by the Compensation Committee will be structured to the extent possible so as to provide Insider Participants with benefits similar to, but not materially greater than, benefits then available to non-Insider Participants.

15.Miscellaneous.

a.Expiration, Termination, Amendments. The Plan shall continue in effect until all of the shares of Common Stock reserved under the Plan (as adjusted pursuant to Section 2) have been purchased, unless otherwise terminated earlier as contemplated below. The Board in its sole discretion may amend or terminate the Plan at any time, provided that any such amendment or termination may not adversely affect the rights or interests of any Participant with respect to the shares of Common Stock or other assets then held in such Participant’s Plan Account without the express consent of such Participant, and provided further that any such amendment requiring the approval of shareholders of the Company under any applicable law or regulation, including the rules and regulations of the Securities and Exchange Commission and National Securities Exchange, will not become effective unless and until such shareholder approval shall have been obtained.

b.No Right to Continued Service. An individual Participant’s right, if any, to continue to serve the Company or any Subsidiary in any capacity, including as an Employee, Director, or Advisory Director, shall not be enhanced or otherwise affected by such individual’s participation in the Plan.

c.Governing Law. The provisions of the Plan shall be construed in accordance with, and governed by, the laws of the State of New York without reference to applicable conflict of laws provisions, except insofar as such provisions may be expressly made subject to the laws of any other state or federal law.

d.Successors. All obligations of the Company in connection with the Plan shall be binding on any successor to the Company.

e.Beneficiaries. No right or benefit under the Plan may be transferred by any Participant to any other party, except upon such Participant’s death and then only pursuant to the terms of a will or other binding instrument governing the transfer of Participant’s assets upon death or the laws of descent and intestacy. All rights and benefits of participation may be exercised only by the Participant during his or her lifetime. In accordance with the procedures determined by the Administrator, if any, a Participant may file with the Administrator or its Agent a written designation of a beneficiary who is to receive any shares and/or cash, if any, from the Participant's Plan Account upon such Participant's death.

f.Shareholder Approval. The Plan, in order to become effective, must be approved by the affirmative vote or written consent of shareholders of the Company holding at least that number of shares required to constitute such approval under all applicable laws and regulations, including the listing requirements and other regulations promulgated by any applicable National Securities Exchange. If not thus approved by the shareholders, the Plan shall be null and void and of no force and effect, and the Original Plan shall continue in effect in accordance with its terms.

* * *